Carbon Taxes Explained: All You Need to Know

Impactful Ninja is reader-supported. When you buy through links on our site, we may earn an affiliate commission.

Learn more

Learn more

.

Hey fellow impactful ninja ? You may have noticed that Impactful Ninja is all about providing helpful information to make a positive impact on the world and society. And that we love to link back to where we found all the information for each of our posts. Most of these links are informational-based for you to check out their primary sources with one click. But some of these links are so-called "affiliate links" to products that we recommend. First and foremost, because we believe that they add value to you. For example, when we wrote a post about the environmental impact of long showers, we came across an EPA recommendation to use WaterSense showerheads. So we linked to where you can find them. Or, for many of our posts, we also link to our favorite books on that topic so that you can get a much more holistic overview than one single blog post could provide. And when there is an affiliate program for these products, we sign up for it. For example, as Amazon Associates, we earn from qualifying purchases. First, and most importantly, we still only recommend products that we believe add value for you. When you buy something through one of our affiliate links, we may earn a small commission - but at no additional costs to you. And when you buy something through a link that is not an affiliate link, we won’t receive any commission but we’ll still be happy to have helped you. When we find products that we believe add value to you and the seller has an affiliate program, we sign up for it. When you buy something through one of our affiliate links, we may earn a small commission (at no extra costs to you). And at this point in time, all money is reinvested in sharing the most helpful content with you. This includes all operating costs for running this site and the content creation itself. You may have noticed by the way Impactful Ninja is operated that money is not the driving factor behind it. It is a passion project of mine and I love to share helpful information with you to make a positive impact on the world and society. However, it's a project in that I invest a lot of time and also quite some money. Eventually, my dream is to one day turn this passion project into my full-time job and provide even more helpful information. But that's still a long time to go. Stay impactful,Affiliate Disclosure

Why do we add these product links?

What do these affiliate links mean for you?

What do these affiliate links mean for us?

What does this mean for me personally?

![]()

Carbon taxes are one way to tackle the issue of global climate change and help us maintain a sustainable planet for future generations. Because they place a cost on carbon emissions, they can help improve environmental health. So, we had to ask: What are carbon taxes really, and could they help us mitigate climate change?

Carbon taxes are a price tag put on fossil fuel emissions to disincentivize their use and promote a switch to clean energy. They do not directly reduce your carbon footprint. However, they work at the core issue of reducing overall CO2 emissions by increasing the cost of using fossil fuels.

Keep reading to find out all about what carbon taxes are, the impact you can have with them both individually and globally, their benefits and drawbacks, and why they may not be the most effective way to mitigate climate change.

The Big Picture of Carbon Taxes

Carbon emissions already have a price tag attached to them, but it is our environment that pays the price, not the emitters. Carbon pricing seeks to resolve this issue and make emitters pay for their carbon emissions. This is commonly known as the polluter pays principle, which states that those who cause the pollution must bear the cost. And one form of this comes in the form of carbon taxes.

A carbon tax is a fee placed directly on the burning of fossil fuels (i.e., coal, oil, and natural gas). And it is the only way to make users of fossil fuels pay for the social, economic, and environmental damage caused when carbon is released into the atmosphere.

“Carbon Tax: a tax on the use of fuels that produce gasses that harm the atmosphere”

Cambridge Dictionary

Placing the tax on the fuel itself creates a monetary disincentive that promotes the switch to cleaner energy by making it more economically rewarding to use non-fossil fuels.

Finland was the first country to implement a carbon tax back in 1990, and now there are 64 carbon pricing policies (carbon taxes and cap-and-trade policies) in operation worldwide. 35 of these are carbon tax programs. As of 2021, Sweden had the highest and Poland the lowest carbon tax at $137 and <$1 per metric ton of CO2 equivalent, respectively. The United States and Australia are currently the only two developed countries without some form of carbon pricing.

| What carbon taxes are | Carbon taxes are fees placed directly on the burning of fossil fuels. |

| How carbon taxes work | A fee is placed on fossil fuels, which creates a monetary incentive to switch to greener forms of energy. |

| The impact of carbon taxes on your own emissions | Carbon taxes do not directly reduce your carbon footprint. |

| The impact of carbon taxes on global emissions | Carbon taxes work at the core issue of reducing overall CO2 emissions. |

| The overall effectiveness of carbon taxes on reducing carbon emissions | Carbon taxes are effective if they are complemented by programs that ensure people are not made worse off from increases in fossil fuel costs. |

| The main benefits of carbon taxes | Carbon taxes can reduce GHG emissions, protect ecosystems, incentivize the switch to green energy, support green jobs, promote energy independence, and raise money to support environmental initiatives. |

| The main drawbacks of carbon taxes | Carbon taxes increase the cost of fossil fuels, can affect entities disproportionately, and can cause a leakage effect. |

How Do Carbon Taxes Work

Carbon taxes operate by placing a price on carbon emissions, which pre-determines the price of total emissions reduction but leaves the amount of emissions reduction up to the market (us) to decide.

How Do Carbon Taxes Reduce Carbon Emissions

The goal of carbon taxes is to reduce carbon emissions in order to mitigate climate change.

- Carbon taxes represent indirect emission reductions. A price is placed on emitting fossil fuels, which creates a monetary incentive to switch to greener forms of energy with less carbon emissions.

When you hear the words “carbon tax”, think about the term “price tag”. Governments set prices that emitters must pay for each metric ton equivalent of carbon they emit. Carbon taxes force emitters to take steps to reduce their emissions in order to avoid paying this tax. The less carbon they emit, the less money they spend, and the less carbon gets released into our atmosphere.

To ensure a healthy planet for future generations, we must reduce our carbon emissions. And one way to do this is by utilizing carbon taxes.

What Impact Do Carbon Taxes Have on Your Own Carbon Emissions

One of the best ways we can aid in the fight against global climate change is to reduce our carbon footprint. And to do this we first have to reduce our own carbon emissions.

- Carbon taxes do not directly reduce your carbon footprint.

Carbon taxes do not directly reduce your own carbon emissions. Putting a price tag on carbon emissions is an indirect method of emissions reduction because people can continue to emit as long as they pay the price.

What Impact Do Carbon Taxes Have on Global Carbon Emissions

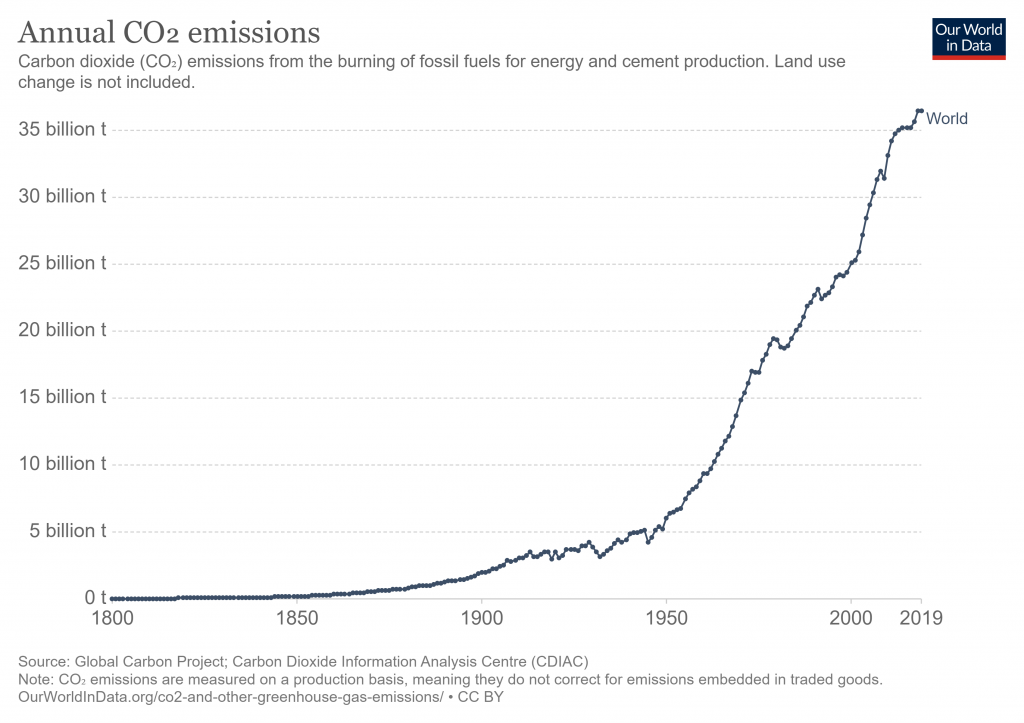

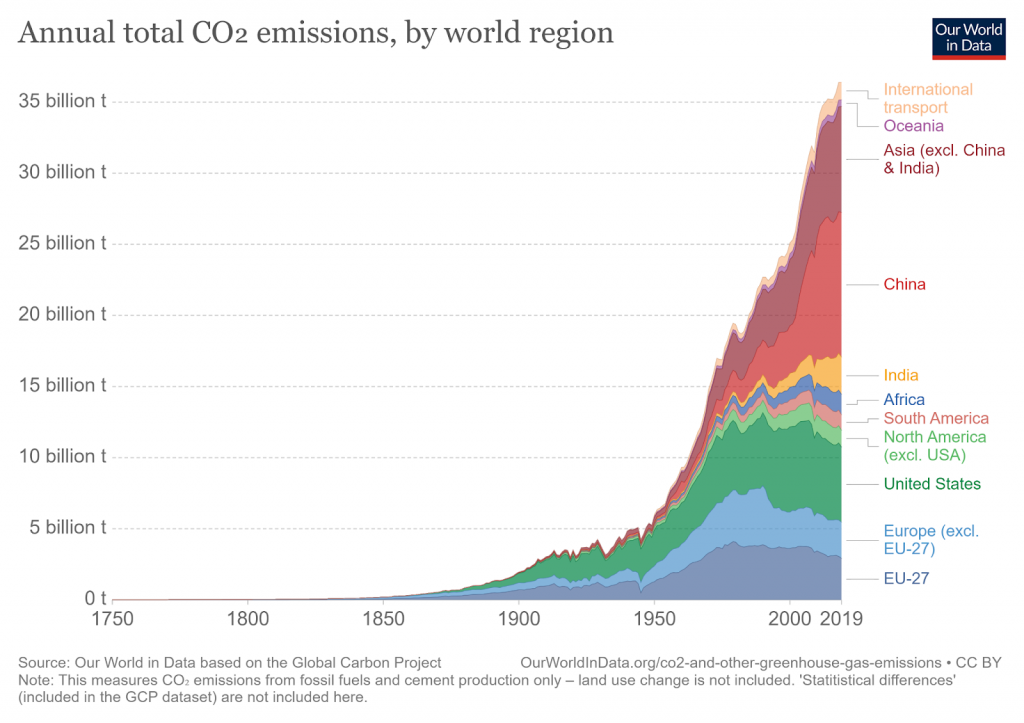

Every year we pump over 36 billion tons of CO2 into the atmosphere, fueling climate change. This causes temperature and sea-level rise, melting of sea ice, changing precipitation patterns, and ocean acidification. Carbon taxes aim to reduce global emissions and mitigate these negative environmental effects.

- Carbon taxes work at the core issue of reducing overall CO2 emissions.

Carbon taxes have a significant impact on global carbon emissions. Carbon taxes internalize external costs on the environment by adding them onto the price of fossil fuels. In this way, the producer and consumer pays for the full price of fossil fuels, including external costs to the environment. Higher prices disincentivizes the use of carbon-intensive goods, which leads to a reduction in total carbon emissions.

The COVID-19 pandemic triggered the largest decrease in energy-related carbon emissions since World War II, a decrease of 2 billion tonnes. However, emissions rebounded quickly and rose by 6% in 2021 to 36.3 billion tonnes, their highest ever level. This indicates that the earth is still warming at an accelerated rate, and still not enough is being done to implement direct carbon reduction measures.

How Effective Are Carbon Taxes in Reducing Carbon Emissions

Carbon taxes can be effective at reducing carbon emissions if they are used correctly.

- Carbon taxes are effective at reducing global carbon emissions if there are contingencies in place to ensure increasing costs do not cause unnecessary hardships for people.

Carbon taxes are effective at reducing carbon emissions because they force emitters to pay for fossil fuel emissions. The money generated from a carbon tax could then be used to offset energy costs for low-income families, fund green energy technology, help combat climate change, or be given back to citizens as a dividend.

But carbon taxes can only be effective if they are complemented by programs that ensure people are not made worse off from increases in fossil fuel costs. Fossil fuels have been powering economies for over 150 years and currently supply approximately 80% of the world’s energy. Increasing the cost of fossil fuels could cause economic hardship for a large percentage of the world.

What Are the Main Benefits and Drawbacks of Carbon Taxes

Supporters argue that a carbon tax would be an effective way to hold companies responsible for their carbon emissions and encourage them to lower them. However, opposers assert that consumers could be willing to pay the increased price and that it may not affect demand because there are limited substitutes for carbon-based commodities (i.e., gasoline, electricity).

What Are the Main Benefits of Carbon Taxes

Using carbon taxes can reduce our consumption of and reliance on fossil fuels, which can reduce the effects of global warming by limiting global GHG emissions. But they also come with various environmental benefits:

- Reduces GHG emissions: By internalizing the external cost of carbon emissions, carbon taxes can curb carbon emissions and incentivize switching to greener forms of energy. These greener forms of energy typically emit less GHGs than traditional fossil fuels.

- Protects ecosystems: Reducing GHG emissions promote healthy ecosystems, which have been linked with cleaner air, water, and food. Protecting forest habitats increases carbon sequestration and defends against erosion. Protecting agricultural land ensures a robust, secure, and prosperous food system. Protecting aquatic ecosystems ensures a readily available supply of fresh water. Lastly, protecting biodiversity protects human health because many plants and animals are used in modern medicines.

- Incentivizes the switch to green energy: Carbon taxes incentivize companies to switch to greener energy sources including solar, wind, hydro, and geothermal energy. They do not emit CO2, nitrogen oxides, sulfur dioxides, or mercury into the atmosphere, soil, or water. And these pollutants are known to contribute to the thinning of the ozone layer, global sea-level rise, and the melting of our world’s glaciers.

- Supports green jobs: The renewable energy sector employed 12 million people worldwide in 2020, with solar energy making up the bulk of those jobs. Renewable energy jobs continue to increase as we start to realize just how beneficial renewable energy is for our environment.

- Promotes energy independence: Switching from fossil fuels to green energy promotes energy independence. Being able to produce your electricity without the aid of foreign countries is an important step in becoming self-sufficient.

- Raises money to support environmental initiatives: The money gathered from implementing a carbon tax can be used to fund and develop other environmental programs that are aimed at reducing GHG emissions.

What Are the Main Drawbacks of Carbon Taxes

As with everything, carbon taxes come with drawbacks that must be understood in order to implement them properly.

- Increases fossil fuel costs: A carbon tax would make fossil fuels more expensive to the general population. In areas where there are limited options for greener energy, this would translate to increased financial burden for some.

- The effects can be disproportionate: Poorer countries, communities, or individuals may be hit harder by a carbon tax because they may not be able to absorb the extra costs. Whereas richer countries, communities, and individuals could more easily absorb the extra costs and continue to pollute at the same rate. This is why setting an appropriate price for the tax is so important.

- Causes a leakage effect: Unless we implement a universal carbon tax, there will be certain countries that will abstain from putting a tax into effect. Countries seeking to avoid the tax could then shift their production to countries lacking a tax and continue to pollute without incurring the extra costs.

Why Are Carbon Taxes Important to Fight Climate Change

As outlined in the Paris Climate Agreement, we must cut current GHG emissions by 50% by 2030 and reach net zero by 2050. Carbon taxes are important to meet this target because they are a way to reduce carbon emissions. This mitigates the effects of climate change, which has a positive cascade effect on public health and plant and animal diversity. In addition, it boosts the global economy and leads to innovative, more environmentally-friendly solutions.

However, carbon taxes should not be used as a panacea for climate change. Relying on them solely is impractical because setting a price is difficult and the amount of emissions reduction is not guaranteed.

In the long term, direct methods of carbon footprint reduction are much more effective. Reducing your household, travel, and lifestyle carbon footprint can go a long way in the fight against climate change!

What are Better Alternatives to Carbon Taxes

If used correctly, carbon taxes can provide environmental, economic, and social benefits beyond reducing carbon emissions. They have the potential to instigate meaningful environmental change and begin to reverse some of the effects of climate change.

However, we can’t let this method be a guilt-free way to reduce carbon emissions. Carbon taxes must be used in conjunction with carbon reduction measures until the industry has time to invest, develop, and refine more sustainable innovations.

These reduction measures don’t have to involve drastic changes either. Actions that may seem small can have a big impact because those small changes add up! You can reduce your carbon footprint in three main areas of your life: household, travel, and lifestyle.

Reduce your household carbon footprint:

- Wash with cold water: Washing clothes in cold water could reduce carbon emissions by up to 11 million tons. Approximately 90% of the energy is used to heat the water, so switching to cold saves also saves energy.

- Replace incandescent bulbs with fluorescent bulbs: Fluorescent bulbs use 75% less energy than incandescent ones, saving energy and thus reducing electricity demand and GHG emissions.

Reduce your travel carbon footprint:

- Fly less: Aviation accounts for around 1.9% of global carbon emissions and 2.5% of CO2. Air crafts run on jet gasoline, which is converted to CO2 when burned.

- Walk or bike when possible: The most efficient ways of traveling are walking, bicycling, or taking the train. Using a bike instead of a car can reduce carbon emissions by 75%. These forms of transportation also provide lower levels of air pollution.

Reduce your lifestyle carbon footprint:

- Switch to Renewable Energy Sources: The six most common types of renewable energy are solar, wind, hydro, tidal, geothermal, and biomass energy. They are a substitute for fossil fuels that can reduce the effects of global warming by limiting global carbon emissions and other pollutants.

- Recycle: Recycling uses less energy and deposits less waste in landfills. Less manufacturing and transportation energy costs means fewer carbon emissions generated. Less waste in landfills means less CH4 is generated.

- Switch from single-use to sustainable products: Reusing products avoids resource extraction, reduces energy use, reduces waste generation, and can prevent littering.

- Eat less meat and dairy: Meat and dairy account for 14.5% of global GHG emissions, with beef and lamb being the most carbon-intensive. Globally, we consume much more meat than is considered sustainable, and switching to a vegan or vegetarian diet could reduce emissions.

- Take shorter showers: Approximately 1.2 trillion gallons of water are used each year in the United States just for showering purposes, and showering takes up about 17% of residential water usage. The amount of water consumed and the energy cost of that consumption are directly related. The less water we use the less energy we use. And the less energy we use, the less of a negative impact we have on the environment.

Because carbon taxes are an indirect way and not a direct way of reducing emissions, they alone will not be enough to reduce global carbon emissions significantly. Direct measures of emission reductions, such as reducing individual energy use and consumption, are better alternatives to carbon taxes.

Final Thoughts

Carbon taxes are fees placed directly on the burning of fossil fuels. Although they do not reduce your carbon footprint directly, when implemented properly they can reduce global GHG emissions, promote energy independence, and incentivize the switch to green energy. The money gathered from a tax can then be used to fund up and coming environmental projects aimed at reducing global carbon emissions. In order to be effective, carbon taxes must be implemented so that the effects are not disproportionate.

Carbon taxes are a good place to start if you want to get into the carbon-emission reduction game, but in order to be effective in the long term, we must not rely on them solely. Cutting emissions from the source is the best way to reduce our carbon footprint and provide the highest environmental benefits.

Stay impactful,

Sources

- Union of Concerned Scientists: Carbon Pricing 101

- The London School of Economics and Political Science: What is the polluter pays principle?

- Carbon Tax Center: What’s a carbon tax?

- Impactful Ninja: What Is the Carbon Footprint of Coal Energy? A Life-Cycle Assessment

- Impactful Ninja: What Is the Carbon Footprint of Oil Energy? A Life-Cycle Assessment

- Impactful Ninja: What Is the Carbon Footprint of Natural Gas? A Life-Cycle Assessment

- Statista: Carbon taxes worldwide as of April 2021, by select country

- Citizens Climate Lobby: Carbon Pricing Around the World

- Center for Climate and Energy Solutions: Carbon Tax Basics

- Our World in Data: CO2 emissions

- National Wildlife Federation: Climate Change

- Tax Foundation: Carbon Tax and Revenue Recycling: Revenue, Economic, and Distributional Implications

- International Energy Agency: After steep drop in early 2020, global carbon dioxide emissions have rebounded strongly

- International Energy Agency: Global CO2 emissions rebounded to their highest level in history in 2021

- World Wildlife Fund: What is a Carbon Tax and How Could it Help us Fight the Climate Crisis

- Environmental and Energy Study Institute: Fossil Fuels

- Natural Resources Defense Council: Carbon Offsets 101

- Carbon Brief: Climate change will hit ‘endemic’ plants and animals the hardest, study warns

- One Green Planet: How Saving Wildlife Benefits Humans – In Ways We Really Need

- World Health Organization: Biodiversity and Health

- International Renewable Energy Agency: Renewable Energy and Jobs – Annual Review 2021

- United States Environmental Protection Agency: What Is Green Power?

- The White House Archives: Fact Sheet – Energy Independence and Security Act of 2007

- Earth.org: Carbon Tax Pros and Cons – Is Carbon Pricing the Right Policy to Implement?

- United Nations Framework Convention on Climate Change: The Paris Agreement

- myclimate: What does “net zero emissions” mean?

- The Ocean Foundation: Reduce Your Carbon Footprint

- Cold Water Saves: Washing Laundry In Cold Water Protects A Lot More Than Just Our Clothing.

- Energy Information Administration: Renewable Energy Explained

- Energy Star: Compact Fluorescent Light Bulbs (CFLs) and Mercury

- Our World in Data: Where in the world do people have the highest CO2 emissions from flying?

- Our World in Data: Which form of transport has the smallest carbon footprint?

- Zero Waste Europe: Reusable vs Single Use Packaging

- Carbonbrief: Interactive – What is the climate impact of eating meat and dairy?

- Stop Waste: Recycling and Climate Protection

- Impactful Ninja: Is Taking Long Showers Bad for the Environment?

- United States Environmental Protection Agency: Showerheads